The Cloud Gets Crowded and more Competitive

The cloud is getting crowded.

In 2022 the cloud computing market – particularly the hybrid cloud – is hotter and more competitive than ever.

Corporate enterprises are flocking to the cloud as a way to offload onerous IT administrative tasks and more easily and efficiently manage increasingly complex infrastructure, storage and security. Migrating operations from the data center to the cloud can also greatly reduce their operational and capital expenditure costs.

Cloud vendors led by market leaders like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure, SAP, Salesforce, Rackspace Cloud, and VMware, as well as China’s Alibaba and Huawei Cloud, are all racing to meet demand. The current accelerated shift to the cloud was fueled by the COVID-19 global pandemic which created supply chain disruptions and upended many aspects of traditional work life. Since 2020, government agencies, commercial businesses and schools shifted to remote working and learning. Although COVID is generally waning (albeit with continuing flare-ups), a hybrid work environment is the new normal. This in turn, makes a compelling business case for furthering cloud migrations.

In 2022, more than $1.3 trillion in enterprise IT spending is at stake from the shift to cloud, and that revenue will increase to nearly $1.8 trillion by 2025 according to the February 2022 report “Market Impact: Cloud Shift – 2022 Through 2025” by Gartner, Inc. in Stamford, Conn. Furthermore, Gartner’s latest research forecasts that enterprise IT spending on public cloud computing, within addressable market segments, will outpace traditional IT spending in 2025.

Hottest cloud trends in 2022

Hybrid Clouds

Hybrid cloud is exactly what its name implies: it’s a combination of public, private and dedicated on-premises datacenter infrastructure and applications. Companies can adopt a hybrid approach for specific use cases and applications – outsourcing some portions of their operations to a hosted cloud environment, while keeping others onsite. This approach lets companies continue to leverage and maintain their legacy data infrastructure as they migrate to the cloud.

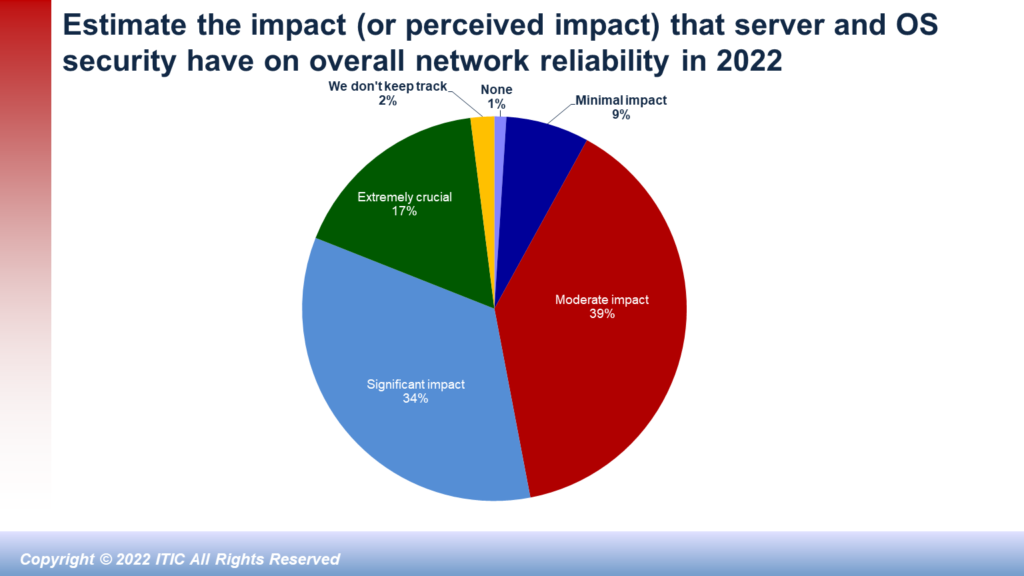

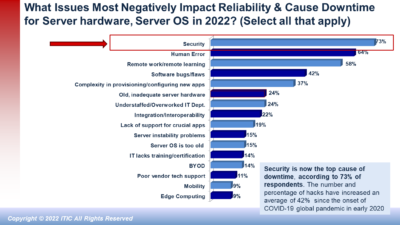

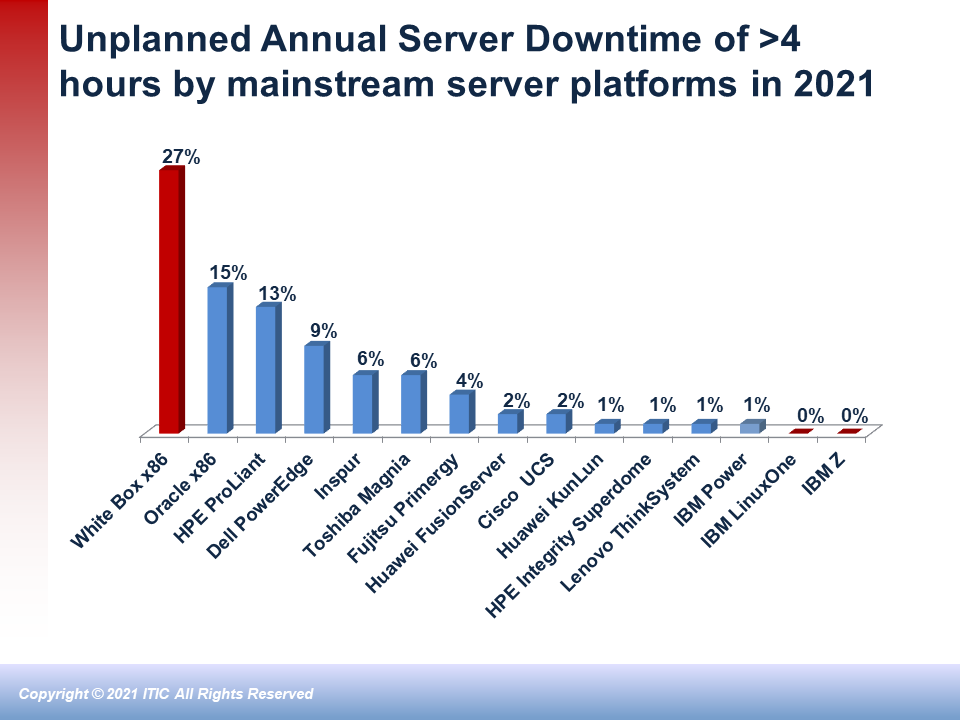

Cloud security and compliance: There is no such thing as too much security. ITIC’s 2022 Global Server Hardware Security survey indicates that businesses experienced an 84% surge in security incidents like ransomware, email phishing scams and targeted data breaches over the last two years that were especially prevalent and commonplace. The hackers are extremely sophisticated; they choose their targets with great precision with the intent to inflict maximum damage and net the biggest payback. This trend shows no signs of abating. In 2021, the average cost of a successful data breach increased to $4.24 million (USD); this is a 10% increase from $3.86 million in 2020 according to the 2021 Cost of a Data Breach Study, jointly conducted by IBM and the Ponemon Institute. The $4.24 million average cost of a single data breach is the highest number in the 17 years since IBM and Ponemon began conducting the survey. It represents an increase of 10% in the last 12 months and 20% over the last two years. Not surprisingly, in 2021, 61% of malware directed at enterprises targeted remote employees via cloud applications. Any security breach will have a domino effect on regulatory compliance. In response, cloud vendors are doubling down on security capabilities and compliance certifications. There is now a groundswell of demand for Secure Access Service Edge (SASE) cloud security architecture designed to safeguard, monitor and access connectivity among myriad cloud applications services, as well as datacenter IT infrastructure and end user devices. SASE gives users a single sign-on capability across multiple cloud applications while ensuring compliance.

Cloud-based disaster recovery (DR): The ongoing concerns around security and compliance issues has also shone the spotlight on the importance of cloud-based disaster recovery. DR uses cloud computing to back up data and continue to run the necessary business processes in case of disaster. Organizations can utilize cloud-based DR for load balancing and to replicate cloud services across multiple cloud environments and providers. The result: enterprise transactions will continue uninterrupted if they lose access to their physical infrastructure in the event of an outage.

Cloud-based Artificial Intelligence (AI) and Machine Learning (ML): Another hot cloud trend is the use of Artificial Intelligence (AI) and Machine Learning (ML). Both AI and ML allow organizations to cut through the data deluge and process and analyze the data to make informed business decisions and quickly respond to current and future market trends.

Top cloud vendors diversify, differentiate their offerings

There are dozens of cloud providers with more entering this lucrative market arena all the time. However, the top four vendors: Amazon AWS, Microsoft Azure, Google Cloud and IBM Cloud currently account for over 70% of the installed base.

Amazon AWS: Amazon AWS has been the undisputed cloud market leader for the past decade. And it remains the number one vendor in 2022. Simply put, Amazon is everywhere and it has amazing brand recognition. Amazon AWS offers a wide array of services that appeal to companies of all sizes. The AWS cloud-based platform enables companies to build customized business solutions using integrated Web services. AWS also offers a broad portfolio of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS). These include Elastic Cloud Compute (EC2), Elastic Beanstalk, Simple Storage Service (S3) and Relational Database Service (RDS). AWS also enables organizations to customize their infrastructure requirements and it provides them with a wide variety of administrative controls via its secure Web-based client. Other key features include: data backup and long-term storage; Service Level Agreement (SLA) of “four nines” – 99.99% – guaranteed SLA uptime; AI and ML capabilities; automatic capacity scaling; support for virtual private clouds and free migration tools.

As with all of the cloud vendors, the devil is in the details when it comes to pricing and cost. On the surface, the pricing model appears straightforward. AWS offers three different pricing options. They are “Pay as you Go,” “Save when you reserve” and “Pay less using more.” AWS also offers a free 12-month plan. Once the trial period has expired, the customer must either choose a paid plan or cancel its AWS subscription. While Amazon does provide a price calculator to estimate potential cloud costs, the many variables make it confusing to discern.

Microsoft Azure: Microsoft Azure ranks close behind Amazon AWS and the platform has been the catalyst for the Redmond, Washington software giant’s resurgence over the last 12 years. As Microsoft transitioned away from its core Windows-based business model, it used a tried and true success strategy: that is, the integration and interoperability of its various software offerings. Microsoft also moved its popular and well-entrenched legacy on-premises software application suites like Microsoft Office, SharePoint, SQL Server and others to the cloud. This gave customers a sense of confidence and familiarity when it came to adoption. Microsoft also boasts one of the tech industry’s largest partner ecosystem. Microsoft regularly refreshes and updates its cloud portfolio. In February, Microsoft unveiled three industry-specific cloud offerings: Microsoft Cloud for Financial Services, Microsoft Cloud for Manufacturing and Microsoft Cloud for Nonprofit. All of these services leverage the company’s security and AI functions. For example, new feature in Microsoft Cloud for Financial Services, called Loan Manager will enable lenders to close loans faster by streamlining workflows and increasing transparency through automation and collaboration. Microsoft Azure offers all the basic and advanced cloud features and functions including: data backup and storage; business continuity and DR solutions; capacity planning; business analytics; AI and ML; single sign-on (SSO) and multifactor authentication as well as serverless computing. Ease of configuration and management are among its biggest advantages, and Microsoft does an excellent job of regularly updating the platform, but documentation and patches may lag a bit. Azure also offers a 99.95% SLA uptime guarantee which is a bit less than “four nines.” Again, the biggest business challenge for existing and prospective Azure customers is figuring out the licensing and pricing model to get the best deal.

Google Cloud Platform (GCP): Like Amazon, Google is a ubiquitous entity with strong brand name recognition. Google touts its ability to enable customers to scale their business as needed using flexible, open technology. Google Cloud consists of over 150 products and developer tools. GCP is a suite of cloud computing services provided by Google. It is a public cloud computing platform consisting of a variety of IaaS and PaaS services like compute, storage, networking, application development and Big Data analytics. The GCP services all run on the same cloud infrastructure that Google uses internally for its end-user products, such as Google Search, Photos, Gmail and YouTube, etc. The GCP services can be accessed by software developers, cloud administrators and IT professionals over the internet or through a dedicated network connection. Notably, Google developed Kubernetes, an open source container standard that automates software deployment, scaling and management. GCP offers a wide array of cloud services including: storage and backup, application development, API management, virtual private clouds, monitoring and management services, migration tools, AI and ML. In order to woo customers, Google does offer very steep discounts and flexible contracts.

IBM: It’s no secret that IBM Cloud lagged behind market leaders AWS and Microsoft Azure, but Big Blue shifted into overdrive to close the gap. Most notably, IBM’s 2019 acquisition of Red Hat for $34 billion gave IBM much needed momentum, solidifying its hybrid cloud foundation and expanding its global cloud reach to 175 countries with over 3,500 hybrid cloud customers. And it shows. On April 19, IBM told Wall Street it expects to hit the top end of its revenue growth forecast for 2022. IBM’s Cloud & Data Platforms unit is the growth driver Cloud revenue grew 14% to $5 billion during the just ended March 31 quarter. Software and consulting sales which represent over 70% of IBM’s business were up 12% and 13%, respectively. IBM Cloud incorporates a host of cloud computing services that run on IaaS or PaaS. And the Red Hat Open Shift platform further fortifies IBM’s hybrid cloud initiatives. Open Shift is an enterprise-ready Kubernetes container platform built for an open hybrid cloud strategy. It provides a consistent application platform to manage hybrid cloud, multicloud, and edge deployments. According to IBM, 47 of the Fortune 50 companies use IBM as their private cloud provider. IBM has upped its cloud game with several key technologies. They include advanced quantum safe cryptography which safeguards applications running on the IBM z16 mainframe which is popular with high end IBM enterprise customers. Quantum-safe cryptography is as close to unbreakable or impenetrable encryption as a system can get. It uses quantum mechanics to secure and transmit data in a way that currently makes it near-impossible to hack. Another advanced feature is the AI on-chip inferencing, available on the newly announced IBM z16 mainframe. It can deliver up to 300 billion deep learning inference operations per day with 1ms response time. This will enable even non-data scientist customers to cut through the data deluge and predict and automate for “increased decision velocity.” AI on-chip inferencing can help customers prevent fraud before it happens by scoring up to 100% of transactions in real-time without impacting Service Level Agreements (SLAs). AI on-chip inferencing can also assist companies with compliance; automating the process to allow firms to cut audit preparation time from one month to one week to maintain compliance and avoid fines and penalties. The IBM Cloud also incorporates the Keep Your Own Key (KYOK) which uses z Hyperprotect in the IBM public cloud. Another key security differentiator is IBM’s Confidential Computing which protects sensitive data by performing computation in a hardware-based trusted execution environment (TEE). IBM Cloud goes beyond confidential computing by protecting data across the entire compute lifecycle. This provides customers with a higher level of privacy assurance – giving them complete authority over data at rest, data in transit and data in use. IBM further distinguishes its IBM Cloud from competitors via its extensive work in supporting and securing regulated workloads, particularly for Financial Services companies. The company’s Power Systems enterprise servers are supported in the IBM Cloud as well. IBM Cloud also offers full server customization; everything included in the server is handpicked by the customer so they don’t have to pay for features they may never use. IBM is targeting its Cloud offering at customers that want a hybrid, highly secure, open, multi-cloud and manageable environment.

Conclusions

Cloud computing adoption – most especially the hybrid cloud model – will continue to accelerate throughout 2022 and beyond. At the same time, vendors will continue to promote AI, machine learning and analytics as advanced mechanisms to help enterprises derive immediate, greater value and actionable insights to drive revenue and profitability.

Security and compliance issues will also be must-have crucial elements of every cloud deployment. Organizations now demand a minimum of four nines of uptime – and preferably, five and six nines of availability – 99.999% and 99.9999% to ensure uninterrupted business continuity. Vendors, particularly IBM with its newly Quantum-safe cryptography capabilities for its infrastructure and IBM Z mainframe, will continue to fortify cloud security and deploy AI.

The Cloud Gets Crowded and more Competitive Read More »